Making Sense Of 5000 Apple Pay - Your Digital Wallet

Thinking about how a significant amount of money, say five thousand, might interact with your digital wallet? It's a pretty common thought, especially as more of us move away from carrying lots of physical cash. Whether it is for a big purchase or just managing your finances, knowing how digital payment methods like Apple Pay handle larger figures can give you a lot of peace of mind.

This discussion looks at what five thousand means in a financial sense and how that figure connects with using a popular digital payment system. We will explore the simple facts about this number and then think about how you might use it, or amounts like it, through your phone or other connected devices. It's really about making your money work for you in the most convenient ways possible, you know.

We will cover some of the ways people think about five thousand, from its basic mathematical definition to how it might show up in your daily spending or bigger plans. It is more or less about getting comfortable with digital transactions, particularly when dealing with sums that feel a bit more substantial. So, let us get into it.

- Sksksk And I Oop

- Corinna Kopf Bronny James

- Potatoes In A Basket

- El Beso De La Medusa

- Disney Pixar Blacked

Table of Contents

- What Does 5000 Mean in Your Wallet?

- Is 5000 a Big Deal for Digital Payments?

- How Secure is Your Money with 5000 Apple Pay?

- Where Can You Use 5000 Apple Pay?

- Thinking About 5000 for Bigger Buys?

- How Does 5000 Fit into Your Financial Picture?

- Getting Started with Digital Money

- What About the Future of 5000 Apple Pay?

What Does 5000 Mean in Your Wallet?

The number five thousand is, quite simply, the whole number that comes after four thousand nine hundred ninety-nine and before five thousand one. It is a round figure, and for many, it represents a notable amount of money. When we think about money in our wallet, whether it is physical or digital, this number often pops up in various situations. It could be a target for savings, a price point for something you want to buy, or perhaps a sum that shows up in bigger financial discussions. It is, in some respects, a common benchmark.

This figure, five thousand, is also an even number. It is made up of two different prime numbers when you break it down, which is a little bit of mathematical trivia. Knowing how to write it out, "five thousand," is pretty straightforward, but its meaning changes depending on where you see it. For instance, five thousand dollars might be a lot to one person, and perhaps just a starting point for another. It is all about perspective, you know.

When you consider how five thousand might relate to your wallet, it is worth remembering that it is just a count. It expresses a specific value. How you use that value, or how you plan to get it, is really up to you. It is also, as a matter of fact, exactly halfway to ten thousand, which puts it in a nice spot on the number line. So, it is a number with some interesting features.

- Wnat A Macaroon

- Helado Viral De Mango

- Bo Jackson Broken Bat

- Monday Shampoo Lawsuit Update

- When Bro Says Meme

The Basics of 5000 and Apple Pay

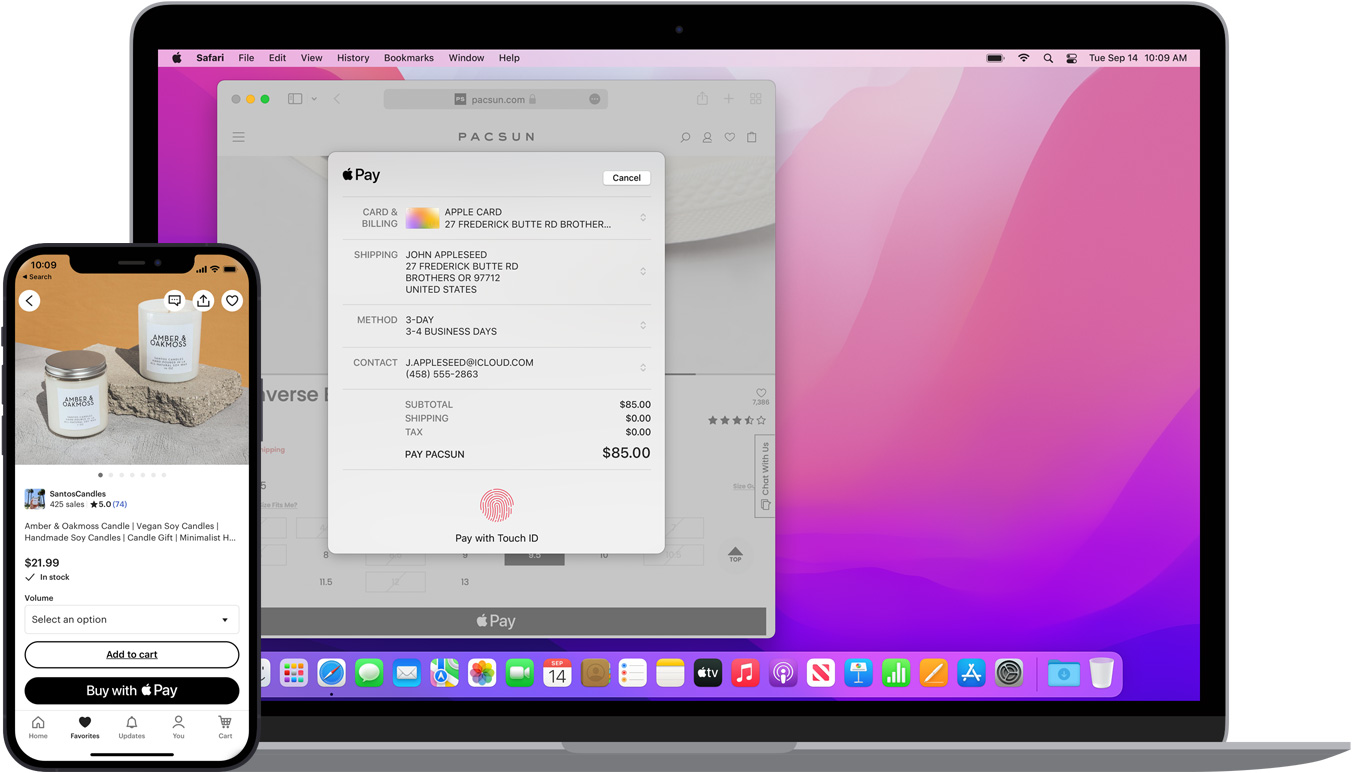

When we talk about five thousand and Apple Pay, we are generally thinking about using a digital service for a sum of this size. Apple Pay is a way to make payments using your phone or other Apple devices, connecting directly to your bank cards without needing to pull out a physical card. It is a pretty convenient setup, as I was saying.

The idea is that if you have five thousand dollars, or any currency, you might consider using a digital method for parts of it, or even for a single large transaction if the situation allows. This means your phone becomes your payment tool. It is about making transactions simple and quick. You are essentially carrying your money in a different form, a digital one, which can be very handy.

Using Apple Pay for any amount, including something around five thousand, means your payment information is kept private. It does not share your actual card numbers with the store. This adds a layer of comfort for many people. It is, you know, a different way to handle your money, one that many find pretty appealing for its ease of use.

Is 5000 a Big Deal for Digital Payments?

For many digital payment systems, a sum like five thousand can be considered a larger transaction. While everyday coffee purchases or small grocery runs are very common, making a payment of five thousand through a phone or watch might feel like a different kind of step. However, these systems are built to handle a wide range of amounts, from the very small to quite large figures. It is just a matter of how they are set up and what limits might be in place by your bank or the store you are buying from. So, it is not necessarily a problem, but it is something to be aware of, basically.

The perception of five thousand as a "big deal" really depends on the context. If you are buying something expensive, like a used car, five thousand might be a partial payment or a full payment for a lower-cost model. For a daily expense, it is certainly a lot. Digital payments make these kinds of transactions possible without needing to carry a lot of paper money or even a physical card. It is pretty useful, actually.

What makes a sum like five thousand significant for digital payments is often the security measures in place. Banks and payment providers put protections around larger transactions to keep your money safe. This might involve extra verification steps, but it is all there to give you confidence. It is a good thing, really, that these systems are built with safety in mind for all sorts of amounts.

Managing Larger Sums with 5000 Apple Pay

When you are looking at managing a sum like five thousand with Apple Pay, it is about understanding the process. Apple Pay itself is a secure way to pass your payment details. The limits on how much you can spend often come from your bank or the credit or debit card you have linked to the service, not from Apple Pay directly. This means you might be able to use it for quite substantial purchases, provided your card has the funds or credit available. You know, it is pretty straightforward.

For amounts like five thousand, some retailers might have their own limits on how much they accept via contactless payments. It is always a good idea to check with the store if you are planning a big purchase. But for online shopping, where Apple Pay is also an option, these limits are often less of a concern, as long as your card supports the amount. It is pretty convenient, in a way, for online purchases.

Thinking about five thousand Apple Pay transactions means considering how you track your spending. Digital wallets often provide a clear record of your purchases, which can be helpful when you are dealing with larger sums. This makes it easier to keep an eye on your money and see where it is going. It is a useful feature, to be honest, for keeping tabs on things.

How Secure is Your Money with 5000 Apple Pay?

When you are thinking about moving a sum like five thousand using any digital payment method, security is probably one of the first things that comes to mind. With Apple Pay, your card number is never stored on your device or on Apple servers. Instead, a unique, encrypted number is created for your device. This makes it very hard for anyone to get your actual card details. It is a pretty clever system, you know.

Each time you make a purchase, Apple Pay uses a one-time code for that specific transaction. This means even if someone were to somehow intercept that code, it would not be useful for future purchases. This kind of protection is a big part of why many people feel comfortable using digital wallets for various amounts, including something like five thousand. It is, essentially, built with safety in mind.

Beyond the technical aspects, you also have the security features of your device itself. Things like Face ID, Touch ID, or a passcode are needed to authorize payments. This adds another layer of protection, making sure that only you can use your device to make purchases. So, it is quite secure, really, when you put it all together.

Protecting Your Digital Cash Flow

Protecting your digital cash flow, especially when dealing with amounts like five thousand Apple Pay, comes down to a few simple habits. Always keep your device's software updated, as these updates often include security improvements. Also, be mindful of where and how you connect to Wi-Fi, especially when making payments. Public networks might not always be the most secure. These are just good practices, basically, for keeping your information safe.

If you ever lose your device, or if it gets stolen, you can use features like "Find My" to lock it or wipe it clean. This helps protect your payment information, preventing unauthorized use. It is a good idea to have these tools set up beforehand, just in case. It gives you a lot of comfort, you know, knowing you have these options.

Finally, keep an eye on your bank statements and transaction history. If you see anything unusual, contact your bank right away. This is a general rule for any financial account, but it is especially important when you are using digital methods for sums like five thousand. Being aware of your account activity is a pretty simple yet very effective way to stay secure.

Where Can You Use 5000 Apple Pay?

The places where you can use Apple Pay are growing all the time. Many stores, both big and small, accept it at their checkout counters. Look for the Apple Pay logo or the contactless payment symbol. It is often displayed near the card reader. This makes it pretty easy to spot where you can use your phone to pay, whether it is for a small item or perhaps a bigger one that might contribute to a five thousand total. It is, in some respects, becoming very common.

Beyond physical stores, you can also use Apple Pay for purchases within apps and on websites. This means you can buy things online without having to type in your card details every time. This is particularly handy for larger online purchases, where you might be spending a good portion of five thousand. It streamlines the whole checkout process, which is quite nice, actually.

From clothing shops to grocery stores, restaurants, and even some public transport systems, the reach of Apple Pay is quite wide. So, if you are planning to spend five thousand, or any part of it, it is very likely you will find many places that accept this payment method. It is designed for convenience, after all, for pretty much any kind of shopping.

Everyday Spending and 5000 Apple Pay

While five thousand might not be an everyday spending amount for most people, the individual transactions that add up to that figure often are. Think about your weekly groceries, a new appliance, or perhaps a holiday booking. Each of these can be paid for with Apple Pay. Over time, these smaller or medium-sized purchases can accumulate to a total of five thousand or more. It is, in a way, how many people manage their finances today.

For example, if you are saving up for something that costs five thousand, you might use Apple Pay for your regular expenses, allowing you to keep your physical wallet lighter. This also helps you track your spending digitally, which can be a good way to stay on budget. It is a tool that helps you manage your money, you know, even if you are not spending the full five thousand at once.

Even for things like ordering food delivery or paying for subscriptions, Apple Pay offers a smooth experience. These are the kinds of regular payments that, when added up, can certainly reach a significant sum over a month or a year. So, while "5000 Apple Pay" might sound like a single big event, it is often a collection of many smaller, convenient transactions. It is pretty flexible, basically.

Thinking About 5000 for Bigger Buys?

When it comes to larger purchases, like a car or a big home appliance, five thousand can be a very relevant figure. Sometimes it is the total cost, and other times it is a down payment. The question then becomes, can you use Apple Pay for such a significant item? The answer often depends on the seller and their payment systems. Many car dealerships or large electronics stores might have limits on contactless payments, but they often accept Apple Pay for online deposits or as part of a larger transaction. It is worth checking with them directly, you know.

For instance, if you are looking for a used car under five thousand dollars, as some listings suggest, you might be able to use Apple Pay for an initial deposit or a portion of the payment if the dealership's system allows it. This can make the buying process feel a bit more modern and less reliant on traditional methods like checks or bank transfers. It is pretty convenient, actually, for these kinds of things.

The convenience of digital payments for bigger buys is that you do not have to carry large amounts of cash. It also provides a clear digital record of your payment, which can be very helpful for tracking and budgeting purposes. So, while the full five thousand might not always go through Apple Pay in a single tap, parts of it often can. It is about finding the right way to use the tools you have, in some respects.

Used Cars and 5000 Apple Pay

Thinking about used cars and how they might connect with five thousand Apple Pay means considering the various ways people find and purchase vehicles. Listings often show many used cars available for under five thousand dollars. These cars often come with reports, like a Carfax, which gives you some history about the vehicle. This helps you make a more informed choice, you know.

While a full five thousand car purchase might not always happen with a single Apple Pay tap, especially at a small, independent seller, larger dealerships or online car marketplaces might offer more flexibility. For example, you could pay a reservation fee or a small down payment using Apple Pay, and then complete the rest through other means. It is pretty common for big purchases to involve a mix of payment methods, anyway.

The idea is that if you are in the market for a car in that five thousand price range, having Apple Pay as an option for any part of the transaction can simplify things. It is about leveraging modern payment methods for traditional big-ticket items. It just makes the whole process a little smoother, actually, for both the buyer and the seller.

How Does 5000 Fit into Your Financial Picture?

The number five thousand can play a few different roles in your overall financial picture. It could be a goal for an emergency fund, a target for a down payment on a house, or even an amount you plan to put into a retirement account. For many people, reaching five thousand in savings or investments feels like a good milestone. It is a solid figure that can provide a sense of security or progress. So, it is pretty significant, in a way, for personal finance.

For example, some companies offer to match contributions to a 401(k) retirement plan. If you are putting money into your 401(k), and your company matches a portion of it, reaching a total of five thousand in contributions can happen faster than you might think. This is a pretty smart way to grow your money, basically, especially when someone else is helping you out.

Understanding where five thousand fits into your financial plans means looking at your income, your spending, and your goals. It is a number that can represent different things to different people, but it usually signifies a meaningful amount that requires some planning or thought. It is, you know, a number that often gets attention in financial discussions.

Saving and 5000 Apple Pay

While Apple Pay is primarily for spending, it indirectly supports saving. By making your everyday transactions easier and providing a clear digital record, it can help you keep track of where your money is going. This awareness is a crucial part of reaching savings goals, like accumulating five thousand dollars. If you know exactly what you are spending, it is easier to find areas where you can cut back and put more money aside. It is pretty helpful, actually, for budgeting.

For instance, if you are saving up five thousand for a specific purpose, using Apple Pay for your regular purchases means you are not constantly handling cash, which can sometimes make it harder to track. The digital trail helps you review your habits and adjust them as needed. This kind of transparency can really help you stay on course with your financial targets. It is, in some respects, a tool for financial discipline.

Think about it this way: if you are trying to save five thousand, every dollar you spend wisely through Apple Pay means you are less likely to overspend in other areas. This frees up more money to put towards your savings goal. It is about making your spending habits work for your saving goals, you know. It is a pretty practical approach to managing your funds.

Getting Started with Digital Money

If you are new to using digital payment systems like Apple Pay, getting started is pretty straightforward. You typically add your credit or debit cards to the Wallet app on your iPhone or Apple Watch. The process usually involves scanning your card or entering its details manually. Your bank might then ask you to verify your card, perhaps through a text message or a phone call. It is a quick setup, basically, designed to be simple for everyone.

Once your cards are added, you are ready to make payments. At a store, you just hold your device near the payment reader. For online purchases, you select Apple Pay at checkout. It is a very intuitive process, which is why so many people find it easy to pick up. You do not need to be a tech wizard to use it, anyway.

The convenience of having your payment methods stored securely on your device means you can leave your physical wallet at home more often. This is a big plus for many, as it reduces the number of things you need to carry. It is about making your financial life a little bit lighter and more accessible, you know, wherever you go.

Setting Up Your Account for 5000 Apple Pay

Setting up your account to handle transactions, including those that might approach five thousand Apple Pay, is mainly about adding your preferred bank cards to your Apple Wallet. You can add multiple cards, like a debit card for everyday spending and a credit card for larger purchases. This gives you flexibility, allowing you to choose which card to use for different situations. It is pretty simple, actually, to add different cards.

To access your Wallet, you usually just double-click the side button on your iPhone or Apple Watch. From there, you can pick the card you want to use. This quick access makes paying very fast, even when you are dealing with a sum that might be part of a larger five thousand total. It is designed for speed and convenience, you know.

If you ever change banks or get a new card, updating your Apple Pay details is also easy. You can remove old cards and add new ones without much fuss. This means your digital wallet can always stay current with your financial situation, ready for any payment, big or small. It is, in some respects, a very adaptable system for your money.

What About the Future of 5000 Apple Pay?

The way we pay for things is always changing, and digital payment methods like Apple Pay are a big part of that. We are seeing more and more places accept contactless payments, and the technology behind them is always getting better. This means that using your phone or watch for even larger sums, like five thousand, might become even more common and seamless in the years to come. It is a pretty exciting time for payments, you know.

As digital security measures continue to improve, and as more people become comfortable with using their devices for transactions, the idea of handling significant amounts of money digitally will just feel more natural. The systems are always being refined to be faster, safer, and easier to use. So, it is pretty clear that digital payments are here to stay and will likely grow even more. It is, in a way, the direction things are heading.

Keeping up with these changes means staying informed about what your bank offers and what new features Apple Pay introduces. It is not about constantly learning new things, but rather being aware of the options that make your financial life simpler and more secure. The future of payments, including how we handle sums like five thousand, looks to be increasingly digital and user-friendly. It is a good thing, really, for convenience.

Keeping Up with Digital Payment Changes

To keep up with the changes related to digital payments, especially when considering sums like five thousand Apple Pay, it is a good idea to occasionally check in with your bank or credit card provider. They often have information about new features or limits that might affect how you use your digital wallet. This helps you stay informed about the best ways to manage your money. It is a pretty simple step, actually, to keep yourself updated.

Also, paying attention to updates for your device's operating system can be helpful. These updates sometimes include improvements to Apple Pay or new ways to interact with it. Staying current means

Detail Author:

- Name : Mr. Ethel Weber DDS

- Username : cindy65

- Email : hebert@yahoo.com

- Birthdate : 1976-09-22

- Address : 31652 Romaguera Plain Lake Cathrine, SD 30187

- Phone : 1-940-746-6109

- Company : Schoen Inc

- Job : Typesetting Machine Operator

- Bio : Temporibus non et aut eligendi et necessitatibus. Consectetur aspernatur doloribus excepturi a atque. Et repudiandae pariatur explicabo veniam in dolorem.

Socials

facebook:

- url : https://facebook.com/isabell4047

- username : isabell4047

- bio : Quis sequi corrupti eos omnis voluptas totam qui.

- followers : 5045

- following : 1875

linkedin:

- url : https://linkedin.com/in/ialtenwerth

- username : ialtenwerth

- bio : Modi sit suscipit eum.

- followers : 2083

- following : 545

tiktok:

- url : https://tiktok.com/@altenwerthi

- username : altenwerthi

- bio : Ipsam harum et id explicabo cupiditate laborum.

- followers : 916

- following : 2700

twitter:

- url : https://twitter.com/altenwerthi

- username : altenwerthi

- bio : Molestiae fuga suscipit iure ducimus temporibus eum. Pariatur ut delectus maxime omnis.

- followers : 1843

- following : 872

instagram:

- url : https://instagram.com/isabell_xx

- username : isabell_xx

- bio : Laudantium nobis rem ad sunt natus quasi aut doloribus. Accusamus vero libero qui iure et.

- followers : 1525

- following : 2596